16 Investment Strategies For The Savvy Real Estate Investor

Have you ever felt overwhelmed by all the different kinds of investment strategies in real estate? Or perhaps you have focused on one investing niche thus far, and are interested in learning about alternative strategies that will help boost your portfolio. Read on to find a briefing on several different types of investment strategies employed by today’s most successful investors.

Have you ever felt overwhelmed by all the different kinds of investment strategies in real estate? Or perhaps you have focused on one investing niche thus far, and are interested in learning about alternative strategies that will help boost your portfolio. Read on to find a briefing on several different types of investment strategies employed by today’s most successful investors.

Choosing The Right Real Estate Investment Strategy

Every investor in real estate wants to make money, but there’s one question weighing on everyone’s mind: How? Many investors find success by focusing on specific niches or strategies within the real estate industry. Perhaps it is time to ask yourself some important questions, such as what are the strategies that make the most sense for your local market? Which strategies would be the most lucrative? Which strategy best compliments your skillset? Are you interested in short-term or long-term investment strategies? And perhaps one of the most important questions of all: In which strategy will you find the most passion? Investors who give a lot of thought to these questions and select the best possible strategy for their local market, skill set and expertise are the most likely to be successful.

[ What’s the best investment strategy for YOU? Take “The 10-Minute Real Estate Investor Personality Test” and find out ]

Best Short Term Investment Strategies

- Wholesaling

- Rehabbing

Short term real estate investing refers to strategies that have a relatively short time horizon, opposed to others that can span over years. Two of the most common short term investment strategies are wholesaling and rehabbing, the former of which represents one of the more popular investment strategies for beginners. Wholesaling arguably requires the least amount of capital investment, with deals that can be executed in a matter of days. As a wholesaler, an investor will find properties listed under market value and then market the same property to other real estate investors. A profit is made by contracting the property, and then selling the contract to an end buyer, along with a wholesaling fee.

For investors who would like a more hands-on approach in real estate might consider rehabbing, also commonly referred to as ‘fixing and flipping’ properties. This strategy involves acquiring, renovating, and then re-listing a property on the market at a higher price. Fixing and flipping is known as one of the best investment strategies in terms of profitability, especially for investors who know how to sniff out great property deals in popular neighborhoods.

Long Term Investment Strategies That Pay Off

- Buy and hold

- Vacation rentals

- Getting a real estate license

Investors who are willing, and have the patience, to wait over a longer time frame to receive their payoff should consider long term investment strategies, including buy and hold, vacation rentals, or even obtaining a real estate license. These strategies generally require a longer payback period after the initial investment is made, but are seen as less risky and more stable. Buy and hold real estate works exactly as one would imagine; an investor will purchase property and hold it for an extended period of time. The investor may plan to sell the property down the line when market conditions are favorable, while many opt to rent out the property indefinitely, comprising one form of fixed income investment strategies. Investors who select this strategy should be sure to pick the right rental market, and make sure they have the resources to manage the property.

As a result of an improving economy and the rising popularity in the private accommodation sector (such as airbnb.com and vrbo.com), investing in vacation rental properties has become an increasingly attractive option. Owning a vacation rental in a popular tourism market can attract a significant amount of revenue. Those who invest in the right markets may even find that revenue from just one weekend will cover the mortgage payment. Investors who select this option should be extremely careful in picking a market, size up competition, and have a contingency plan for slow seasons.

The topic of getting a real estate license to benefit your investing career can be quite controversial. Some successful investors will maintain that having a successful investing business is not dependent on having a real estate license, while others will passionately argue that having a license provides a competitive advantage. Those who argue against obtaining a license may bring up the points of strict brokerage requirements and disclosure regulations, not to mention the significant costs and time it requires to become licensed. On the other hand, the added benefits enjoyed by investors who also have a real estate license include getting sales commission, gaining unlimited access to the MLS, and being able to control their own business transactions. In sum, the time and resources to obtain and maintain a valid real estate license can inhibit some investors, while others believe the benefits are well worth the effort.

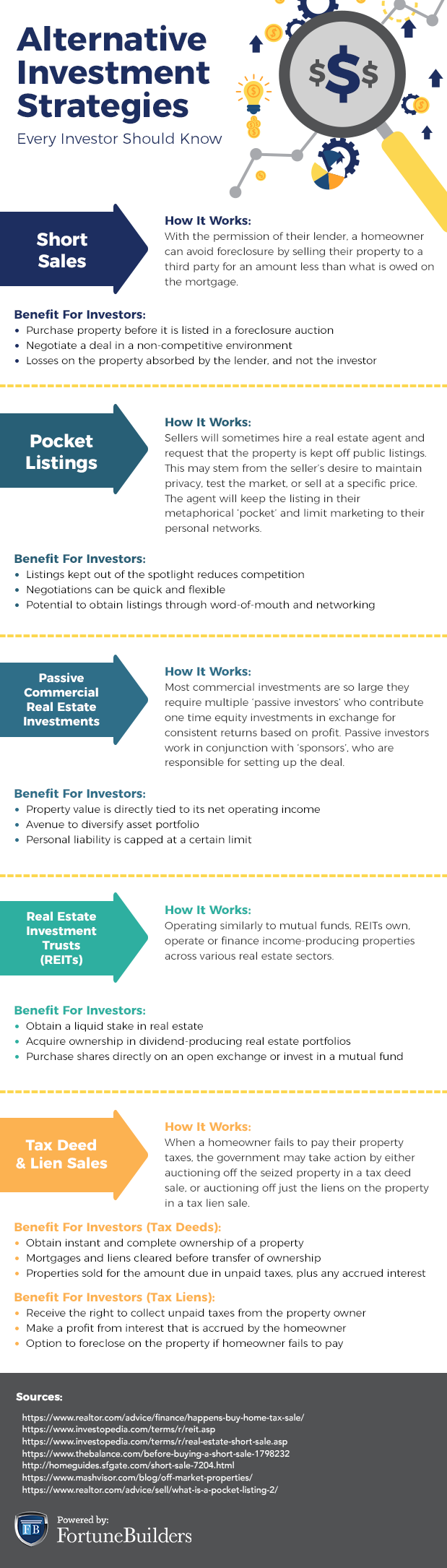

Alternative Investment Strategies

- Short sales

- Pocket listings

- Passive Commercial Real Estate Investments

- Real Estate Investment Trusts

- Tax deed and tax lien sales

For investors who wish to go a bit off the beaten path from traditional investment strategies, perhaps the above alternative investment strategies are of interest. For starters, investors can begin by looking for potential foreclosure deals before they are even listed and negotiate a short sale. In a short sale, the homeowner, buyer, and lender must all agree to conduct a property transaction so that the homeowner can avoid being foreclosed upon. The buyer is able to acquire the property for less than what is owed on the mortgage, while the lender is incentivized by the ability to avoid the foreclosure process. This strategy can be quite a win-win scenario if negotiations go well and the lender approves the deal.

Pocket listings are another type of investment opportunity in which a property never gets listed. For one reason or another, a seller will ask their agent to keep the listing in their metaphorical ‘pocket’ and abstain from publicly marketing the property. Instead, the agent will rely on their personal networks to find a buyer. In these cases, investors who are notified of pocket listings get the benefit of negotiating in a swift and flexible manner, while avoiding the stiff competition that is associated with public listings.

Aside from off-market listings, investors can also consider stock investment strategies, which include passive commercial real estate investments and real estate investment trusts. These two strategies are especially appropriate for investors who have some liquidity to invest, yet want a more hands-off approach. In passive commercial real estate investing, sponsor firms will coordinate and execute commercial real estate deals, while investors contribute equity investments in exchange for consistent returns that are based on profit. Investors are able to diversify their asset portfolios while capping their personal liability to a certain limit. If this sounds like a good fit, perhaps real estate investment trusts (REITs) will also be of interest. Operating similarly to mutual funds, REITs own, operate or finance income-producing properties across various real estate sectors. Investors can receive dividends by purchasing shares directly on the open exchange, or by investing in a mutual fund.

Finally, tax deed and tax lien sales represent some of the more creative investment strategies available. Both the tax deed and tax lien processes are triggered when a homeowner fails to pay their property taxes, and the government intervenes. In a tax deed sale, the government seizes the property and auctions it off to the highest bidder. In the case of a tax lien sale, the government will instead place a lien on the homeowner’s unpaid taxes, and will auction off the lien itself. The investor who acquires the lien will then have the right to collect the unpaid taxes, plus any accrued interest from the homeowner. If the homeowner fails to pay the investor, the investor then has the right to foreclose upon the property. Investors should be wary when pursuing these options, as the auction process can drive up the sale price. In addition, the investor assumes responsibility if a foreclosure becomes necessary.

Below you will find a guide to alternative investment strategies, including benefits to each, that you can keep as a quick reference:

Investment Strategies For Retirees

- Retire in 25 years by the age of 60

- Retire in 10 years by the age of 60

- Retire in 10 years by the age of 45

Every individual should be considering different investment strategies for retirement, regardless of age and income. Although it is so easy to put off retirement planning, getting an early start as possible is critical. To get started, it is important to ask yourself at what age you would like to retire, how many years you have until you reach that age, and your desired retirement income. Above is an outline of potential scenarios to begin thinking about investment strategies by age.

In many cases, individuals will plan on working and saving up their earnings until they reach retirement, after which they plan to withdraw from their savings until it is depleted. To put this in bleak terms, individuals would hope that their savings would last them until death. Unfortunately, the average American is nowhere near on the path to have enough saved by retirement. However, it is possible to invest your savings in such a way that your wealth continues to build, even with retirement withdrawals. Additional benefits include being able to retire earlier than planned, being able to live off more than average in retirement, and maintaining or increasing your net worth.

Regardless of your scenario, some key components required in retirement investment strategies include the equity in your principle residence, savings and returns in investment accounts (such as your 401K), and cash savings to be used for real estate investments. Next, based on your current age and how long you have until your desired retirement age, you will need to figure out how aggressively you want to pay down debt and increase your savings. Many investors make it a top priority to pay off their mortgage and other outstanding debts so that their income can be allocated freely toward savings and investments. Once enough cash is saved, you can invest in rental properties, which will produce a steady stream of revenue that will build your wealth even after retiring. Coach Carson provides an excellent illustration of how investors can own rental properties free and clear so that there will be no debt carried into retirement.

Personal Investment Strategies

- 401(K)

- Self-directed individual retirement account

- Mutual funds

Although one may argue that personal investment strategies are not real estate investment strategies, they are critical aspects of building a solid financial foundation that make real estate investing possible. Some of these strategies include contributing to a 401K, a self-directed IRA, and investing in mutual funds. A 401K is a contribution-based retirement savings account that is managed through your employer. You can voluntarily contribute a percentage of your paycheck pre-tax, which also helps to lower your taxable income. Many employers also provide some form of contribution matching program. Self-directed individual retirement account (IRA) provides individuals with the opportunity to create alternative investments, usually through private financial institutions. Some of these alternative investments can include real estate, oil, gas, or intellectual property to name a few. Finally, mutual funds are portfolios are a mix of stocks, bonds and securities that are managed by a financial expert. Various investors contribute to purchase shares of the mutual fund, helping these investors gain access to portfolios they would not be able to build individually.

After all is said and done, choosing the right investment strategies is an extremely personal decision. There are real estate investing experts who will argue strongly for or against any type of strategy, and fairly so, as there are benefits and risks associated with each. Those looking to kick off, expand or completely change their investing portfolio should make sure to conduct thorough research, examine their current financial standing and resources, and take realistic stock of their skill set before selecting the right strategy.